The PF for employees and employers is generally regarded as the most common tool for all salaried Indians to save for their future retirement. But still, some people struggle to find the correct answer and thereby question what exactly this provident fund is? Here’s the piece of writing that will help you to know more.

A Provident fund is mainly the statutory benefit required to be paid to employees working in India. Any fund placed in the Provident Fund is mainly handled by an investment management company which will come in accordance with the specified investment policy to maximize the financial returns, even though there is an acceptable risk level.

Furthermore, you need to know that The Provident Fund, which is registered with the Securities and Exchange Commissions or SEC, is the most unique legal spectrum. This entity is completely separated from the investment management company and, of course, the employer. As a fact of the matter, the employees or provident fund members can be assured enough that if the Investment management company or the employer becomes financially insolvent, the fund’s asset can never be affected by any kind of liabilities from the former’s side.

Concept of EPF or Employees’ Provident Fund

Now the time has come when you need to start from the scratch to know what EPF is. So, let’s dive in, shall we? EPF is a scheme aimed at improving the employees’ future. This welfare or statutory benefit is available to the employees when they are exempted from the service or their post-retirement period. However, in the absence of the employees, that is, if they are deceased, then their family members will be entitled to receive the benefits. Under the employee PF scheme, both the employee and employer must contribute to this fund. The interest earned on this amount shall be included in the member’s provident fund account. And the employee can bag it only after his or her retirement.

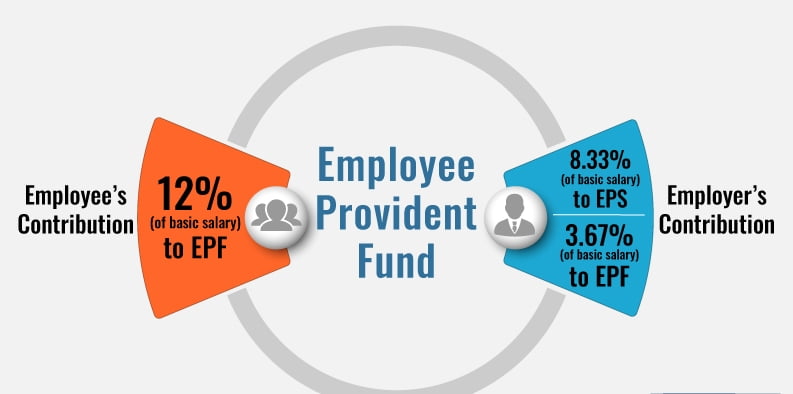

The PF Contribution by the Employer and Employee

Under this Scheme, the PF Contribution payable by both the employee and employer is 12% of PF wages. In fact, from the employer’s share of contribution, an approximate amount of 8.33% is generally contributed towards the employees’ Pension Scheme, and the remained share of 3.67% is contributed to the EPF scheme. And now, do you really want to know what exactly the Employer’s contribution towards the Employees’ Deposit-linked Insurance Scheme? Then the answer is that it is 0.50%, and additional administrative charges are also 0.50%. On the other hand, when it comes to the contribution, the employee or employer can contribute beyond the wage ceiling limit of fifteen thousand rupees per month.

Eligibility of EPF

There are certain requirements that the Employee must meet for the PF membership.

For example, any person who is working for wages in any establishment manually or otherwise is eligible. On the other hand, any person who is engaged as an apprentice or employed through a contractor but not under the Apprentices Act, 1961, is also eligible. Then again, any person under the standing orders of any establishment earning less than fifteen thousand per month other than the exempted or excluded employees under section 17 of the act is also eligible to apply for the provident fund.

The withdrawal process from the EPF account

Emergency? Want to withdraw a substantial amount? It’s simple. The fund from the EPF account can be withdrawn when there is a full settlement on attaining fifty-eight years of age or on the verge of retirement. On the other hand, if an employee stays unemployed for a period of two months or more or in case of death while in service before hitting the retirement period, the employee’s legal heir is eligible to withdraw the accumulated amount.

Also, if you want to make a partial withdrawal from the EPF because of the educational opportunities, medical treatment, marriage, purchasing properties, etc, a year prior to retirement or facing unemployment for more than one month.

The added benefits of PF

There are several benefits pivoted around the Provident Fund. Some of them are – if you are an employee, then you can take advances of this fund and make a withdrawal. Here, the employer is not contributing to the PF but at the same time making necessary additional contributions towards the employee’s pension. The employee can get the tax-free returns after being exempted from the income tax act’s tax benefit. The employers also receive some extra special benefits in the form of extra income to their savings in the body of interest.

On a final note, you should know that for ages, people have been considering Provident Fund as a great way to save some amount for future retirement. Apart from that, it also acts as the emergency fund in case you are in need of money for loans, health expenses, marriage, and many more, as mentioned before!