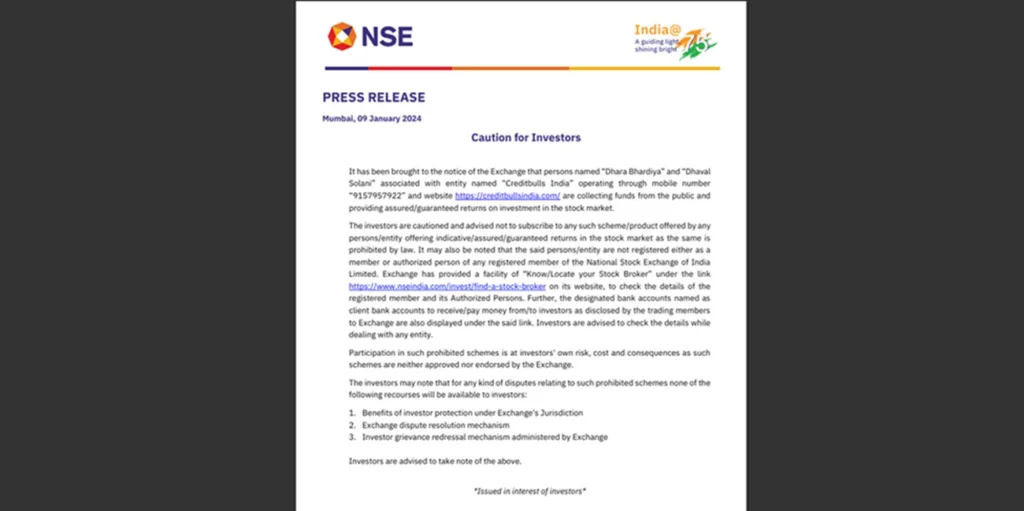

In January of 2024, NSE (National Stocks Exchange of India Limited) issued a warning notice against the multi-crore investment company Creditbulls, highlighting how the company had been making unrealistic claims of ‘No Risk, High Returns’ money return guarantee plans.

NSE further said that offering such guaranteed returns ‘is prohibited by law.’ The organization advised investors not to fall prey to such a scam.

A few days later, the CEO of Creditbulls, Dhaval Solani, was reported to have fled to Dubai – now it is being said that he has further moved to Morocco with investors’ hard-earned money.

What Happened To The Investors’ Money?

It is being reported that a total of money worth of 30-40 crores has vanished after the founders locked the form and disappeared from the scene.

Creditbulls scammed individuals who lost lakhs, including retired elderly, regular middle-class families, working women, and students. They are all ordinary people like you and me, with small savings to spare.

More than 500 people from Jamnagar and Rajkot have reported the disappearance of their hard-earned money. However, the victims of this scam are spread out all across India, including people from Kolkata, Bengaluru, Patna, Chandigarh etc.

The Creditbulls scammed victims filed an FIR earlier this year, after which the manager, Pankaj Vadgama, was arrested on March 30th, 2024.

Scam Creditbulls Dhaval Solani & Associates: Understanding The Ponzi Schemes of 2024

Creditbulls was a private investment company from Pandit Nehru Marg in Jamnagar, Gujarat.

They lured several working-class people and small people in business to invest with them by making promises of very high interest rates. They specialized in CIS (Collective Investment Scheme).

Marketing themselves as Creditbulls and providing the highest interest rate to investors, they did the following:

- Asked investors to entrust money to them that they would then invest in the stock market

- Promised no risk, guaranteed monthly income

- Provided investors with company documents and a portal through which they could track their money

What is a Ponzi Scheme?

Imagine someone telling you they have a great way to make money by investing. They promise to give you significant returns if you invest with them.

But instead of investing your money, they use the money from new investors to pay the returns to older investors. It keeps going like this: an endless chain that generates no new revenue.

Instead, founders and managers like Dhaval Solani, Farjana Irfan Ahmed Sheikh, Pankaj Praveenbhai Vadgama, and Yash Dineshbhai stuff their pockets from this illegal earning!

Eventually, there aren’t enough new investors to keep it going, and the scheme collapses, leaving many people losing their money.

Fake, Unverified Reliability?

The private firm also tried to establish its credibility by publishing journalistic articles about themselves. Huge Finance News houses like Fortune India and Forbes India have publically released articles on Dhaval Solani and his company in the past.

Most of these are sponsored posts that the company probably wrote for itself. But the regular reader is often unaware of this.

“The company’s USP is that it provides 100% on-time payment, excellent customer service, the highest return in the industry.” – Creditbulls has freely made comments like this on the internet, lurking unsuspecting investors to their graves.

This fraudulent institution operated for the last two years, promising extra returns to those investors who could get their friends and family to invest with Creditbulls.

Justice for Investors

As of now, not much progress is being seen from the end of government. However, an investigation is in progress.

In the announcement issued in January 2024, NSE clarified that the private company Creditbulls India was not registered with the National Stock Exchange of India. So, they were not even recognized stock brokers.

NSE for the status that investors involved in prohibited schemes could not be covered by the general legal rights investors associated with NSE usually enjoy.

The vast majority of investment scams that happened in India in the last several decades are proof that it is tough for individual investors to get their money back. Individual investors had entered five lakhs to up to 50 lakhs INR in their Creditbulls scammed accounts.

How to Protect Yourself from A Fraud Investment Scheme?

Firstly, any broker, firm, or institution that says they can invest in another company or the stock market and still provide guaranteed money back is already a red flag.

As investors, it is a must that we keep our eyes open. We must remain vigilant against Ponzi schemes like Creditbulls, which prey on financial ignorance and trust.

- The first step is to establish a financial discipline involving strict research and verification of investment opportunities before we give our hard-earned money to someone.

- Anyone can have a business license or GST number, so one we need to look at instead is a CIS no and SEBI registration no. under which a genuine company operates. Every genuine Collective Investment Scheme in India must operate under the guidance of SEBI.

- Only trust recognized Banks or NBFCs can be trusted with our money. Such organizations will only provide realistic money growth rates – compound interest that is too high is already a sign of a scam!

- In today’s world, it is essential to recognize that the internet is easy to manipulate. We cannot trust everything we see online, especially dubious digital marketing strategies and fake awards.

Final Thoughts

Creditbulls India was operating a Ponzi scheme, exploiting investors through false promises of high returns.

The company engaged in deceptive practices, misleading clients and ultimately causing financial losses. Such schemes are illegal and unethical – and while on the one hand.

We must persuade the government to establish stronger laws against digital scams, on the other hand, we must be careful with our money as individual investors.

Investors should be cautious of such companies, operations, and promises -instead, seek reputable financial advice from well-known firms and brokers who have been in the market for decades.

Know more about stock trading,

Leave a Comment

You must be logged in to post a comment.