How to Save Tax In India Tips And Grow Your Wealth: Indian IT (income Tax) Act 1961 Allow For Certain deduction. Which can be claimed to save tax at the time of filing of income tax Return. By all classes of taxpayers like salaried, individuals,professional,Businessman etc. These tax deduction are Helping to saving Tax Are Only Available. If taxpayer has done proper tax planning during the Year. So, lets start our article on how to save tax by salaried person or others business people.

How to Save Tax?

Before heading to save tax ideas, we need to prepare our mind with how this tax planning work and how to get maximum benefits out of it.

First find out Income Tax Slab Rates for 2015-16 in India:

The Income Tax Slab Rates are different for different categories of taxpayers. The Income Tax Slab Rates can be divided in the following categories:-

A.INDIVIDUALS & HUF

- For Male Individuals below 60 Years of Age and HUF

- For Female Individuals below 60 Years of Age

- All Senior Citizen above 60 years of Age

- For all Super Senior Citizen above 80 years of Age

B. BUSINESSES

- Co-operative Society

- Firms, Local Authority & Domestic Company

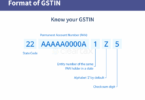

- Know more about How to check GST registration status in India?

How To Save Tax In India Tips And Grow Your Wealth.

Here are the best investment options to save tax in India.

For Male Individuals below 60 years of Age (Senior Citizen):

| Income Tax Slabs | Income Tax Rates |

| Where Total Income does not exceed Rs. 2,50,000 | NIL |

| Where the Total Income exceeds Rs. 2,50,000 but does not exceed Rs. 5,00,000 | 10% of the Amount by which it exceeds Rs. 2,50,000 |

| Where the Total Income exceeds Rs. 5,00,000 but does not exceed Rs. 10,00,000 | 20% of the Amount by which it exceeds Rs. 5,00,000 |

| Where the Total Income exceeds Rs. 10,00,000 | 30% of the Amount by which it exceeds Rs. 10,00,000 |

For Female Individuals below 60 years of Age (Senior Citizen):

Income Tax Slabs for Males and Females are the same and are as follows:-

| Income Tax Slabs | Income Tax Rates |

| Where Total Income does not exceed Rs. 2,50,000 | NIL |

| Where the Total Income exceeds Rs. 2,50,000 but does not exceed Rs. 5,00,000 | 10% of the Amount by which it exceeds Rs. 2,50,000 |

| Where the Total Income exceeds Rs. 5,00,000 but does not exceed Rs. 10,00,000 | 20% of the Amount by which it exceeds Rs. 5,00,000 |

| Where the Total Income exceeds Rs. 10,00,000 | 30% of the Amount by which it exceeds Rs. 10,00,000 |

How to Save Tax Under Section 80:

- Save Tax under Section 80C,

- Tax saving under Section 80CCC,

- And Section 80CCD.

Direct the savings of the common man into the rightful resources. The Govt allows certain deductions provided the amount saved is investment.

The maximum combined deduction allowed under these 3 sections is Rs. 1,50,000.

If you’ve done proper tax planning during the year. You can claim these deductions to save tax by investing under any of these sections alone or in combination. But the total deduction allowed would be limited to Rs. 1,50,000 only.

- PPF Accounts

- 5 Year Tax Saving Fixed Deposit

- Equity Oriented Mutual Fund

- Pension Plans

- Contribution to Employee Provident Fund

- Life Insurance Policy

- National Savings Certificate (NSC)

How to Save Tax by Donation in India?

- Income Tax Deductions for Donations u/s 80G

If a taxpayer makes a donation for charity, social or philanthropic purpose. Or makes a contribution towards National Relief Fund. Then this donation can be claimed as a deduction u/s 80G of the Income Tax Act.

100% of the donation made is allowed to be claimed as a deduction. Whereas in certain cases only 50% of the donation made is allowed to be claimed as a deduction for the purpose of saving taxes.

Deductions made through cash, only Rs. 10,000 would be allowed to be claimed as a deduction.

For claiming deductions above Rs. 10,000, the taxpayer would have to make the donation through cheque. Know more about Cheque Rules in India From The Reserve Bank of India.

Home Loan – Tax Planning through Home Loan:

If you have taken a Home Loan, you are allowed to claim deduction for repayment of principal amount of home loan u/s 80C.

Allowed to claim deduction of interest paid on home loan under section 24.

The maximum deduction allowed in some cases is Rs. 2,00,000 and in some cases there is no maximum limit of claiming this deduction for payment of interest on home loan.

Tax planning for the purpose of save tax by taking a Home Loan is highly advisable. As the Deduction allowed for repayment of home loan can be claimed under 3 different sections resulting in huge tax savings to the taxpayer.

Education Loan – Save Tax through Education Loan u/s 80E:

If a taxpayer has taken an education loan for the higher education of himself or spouse or children or the student of whom he is the legal guardian, he can claim deduction under Section 80E and save taxes.

This deduction is only allowed for the repayment of interest and not for the repayment of principal amount of education loan.

There is no maximum limit for claiming deduction under section for the repayment of interest on education loan. Deduction under Section 80E is only available for Individual taxpayers and not to

FD – 5 Year Bank FDs:

This is a variant of the regular Bank FD with a 5 year lock in. They offer slightly higher interest rates compared to normal FDs (0.25-0.5% higher) but does not offer liquidity option- even premature withdrawal with penalty is not possible.

The amount you can invest is limited to Rs 1,50,000.

The interest you earn on your 5 year bank FD is fully-taxable. And you will have to pay taxes on a yearly basis for the interest you earn for that period.

TDS typically collected by banks is only 10% (20% in case you have not submitted your PAN.) And if you happen to be in the 20 or 30% tax bracket. You need to pay the remaining interest while filing your IT returns.

Post-tax, 5 year bank FDs are not particularly attractive- especially for people in the 20 and 30% tax brackets. Since the post-tax returns (6-7%) are typically lower than other tax saving investment options.

Life Insurance Premium:

This was almost the default tax saving option for years. However, over the last few years, most informed investors have learn the perils of choosing this option.

There are 2 kinds of Life Insurance Policies:

- Pure risk also called term life which ensure a risk to the life of the insured.

- Risk+ investment: which pay you back money over time.

While pure risk life insurance is something everyone with a dependent must have, it’s not an investment. Life insurance is an expense- something you pay to ensure that your dependents are not left stranded should something unfortunate happen to you.

Term life insurance is cheap and for a sum of about Rs 10000, you can purchase a cover of Rs 1 Cr.

The returns from and costs of investment oriented insurance policies are not transparent and usually not attractive. We won’t go into length on this topic but suffice to say that you should not consider Life Insurance as a tax saving investment option.

National Pension Scheme:

National Pension Scheme is a lot like investing in mutual funds with its Safe, moderate and Risky options. The returns are not guaranteed.

You cannot withdraw until 60 and the corpus amount must necessarily be invested in an Annuity. The withdrawals are also taxable.

Contributions up to Rs. 150,000 are eligible for deduction under Sec 80C.

You can invest via the specified list of NPS fund managers with points of presence operated through banks. However, give the restrictions that come with NPS, it’s not a recommended option.

Pension Funds:

Pension funds are design to provide you an income stream post retirement. They come in two flavors:

- Deferred Annuity

- Immediate Annuity.

For deferred annuity plan: You are invest annually until your retirement. Once you reach your retirement, you have can withdraw up to 60% of your accumulated corpus. And you have to re-invest the remaining in an annuity fund which will give you a monthly pension.

When it comes to immediate annuity plans: You invest a bulk amount one-time and get monthly pension from the next month itself. You would typically use these to invest your retirement corpus.

Pension funds are offer by a number of providers. Contributions up to Rs. 150,000 are eligible for deduction.

Pension funds are not very popular because of the sub-par returns (around 6%) that they give and the restriction they come with. That’s less than India’s inflation rate and not even half of what ELSS funds provide in the long run.

Get ideas about Indian Govt.

- What is Surge Pricing Charges in Apps Based Taxi or Radio Cabs in India?

- How to check GST number online and apply online gst registration.

- How to maintain Healthy GST accounts and records? Must follow Steps.

- What is Fat Tax? India Introduce First Time in Kerala.

- TDS – A Tax Deducted at Source Guide For Property Buyers.

- You May Have To Pay Double Tax If Have An Empty House?

So, friends this guide for save tax is helping you in future to curb your hard money. But as a Citizen of India, our moral duty to contribute in development in progress of Country. We all have to pay our taxes on regular basis.